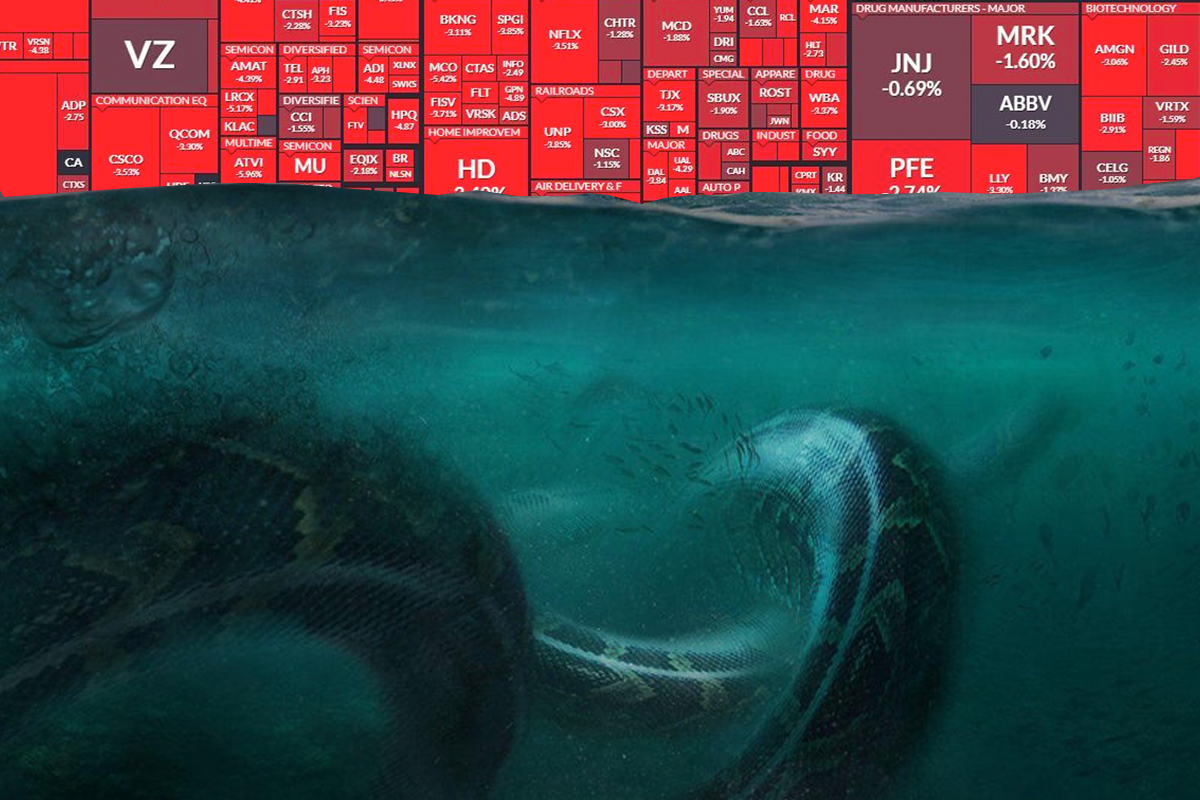

Something big is lurking in Wall Street’s dark pools

BY JACK TAZMAN

DECEMBER 27, 2022

To the retail investor, dark pool history and current activity is every bit as unsettling as it sounds.

The stock market is a place where the public has access to owning a little slice of the American economy by buying fractional ownership of companies. Once a company goes public, their financials and ownership composition are subject to reporting requirements and regulation. …Right?

If the above statement sounds reasonably accurate to you, you are probably going to get absolutely steamrolled as a retail investor. When it comes to trading what you don’t know will almost certainly hurt you.

Remember that as a rule, complexity and obscurity are the nukes in Wall Street’s arsenal of advantages over retail investors. Wall Street spends top dollar fighting any attempt to bringing transparency to their practices or strongholds on power and control. Upholding this rosy but outdated perception of the market is just one of the many tools in their box.

In this continuation of Upside Chronicles‘s Wall Street toolbox of market manipulation, we’re diving into the murky waters of dark pool trading.

What are dark pools?

Dark pools are marketplaces where Wall Street can make trades and execute strategies outside of the public eye.

The general public does not have direct access to dark pools, which are also referred to as alternative trading systems (ATS).

Those that do have access to their murky waters are able to trade privately and directly with other participants. While dark pool volume is reflected “on the tape,” whether the trade was a buy or sell is not.

Dark pools do have some reporting requirements. Every week, the total ATS activity is listed by security on FINRA’s website.

However, by the time the data goes public, it is already out of date. Remember, this is coming from the industry that has the infrastructure to check multiple exchanges for prices in nanoseconds and execute billions of trades per day. But when it comes to basic transparency reporting….30-day latency.

Retail investor orders often get filled in dark pools through the payment-for-order-flow business model. In the GameStop run up earlier this year, it was revealed that Robinhood was routing its order flow to marker maker Citadel for fulfillment. That means Citadel essentially had exclusivity in processing Robinhood investor orders.

The way a healthy public market would work is that all participants – regardless of how deep their pockets – would be able to see the same pre-trade data, also known as the order book. This information is key to calibrating the buy and sell pressure on stocks to determine where their price is heading.

That is exactly why it is hidden from public view.

Rule 19c-3: There are no rules for Wall Street

True to their nature, dark pool trading slithered into legal standing through a seemingly innocuous enough, cleverly named ‘Rule 19c-3.’

In the Federal Register entry regarding the adoption of this rule, the SEC (yes, the commission tasked with regulating the markets) referred to it as a ‘limited proposal.’

For all the grandstanding Wall Street does decrying regulation, Rule 19c-3 is one Wall Street never complains about. That’s because it’s not really a ‘rule’ insomuch as an override of regulation pertaining to basic market transparency and fairness. Of course, those rules still apply to everyone else — the more money you have, the more of the full picture you get to see.

Prior to the passage of Rule 19c-3, trading in public companies had to be done…well, publicly. Dark pools were illegal between 1933–1978 under the Securities Act of 1933, passed during the Great Depression after the stock market crash of 1929.

There was significant opposition to the passage Rule 19c-3, which SEC defines as a ‘regulatory measure.’ Paradoxically, the “rule” actually reverses a real regulatory measure. Pointing out the obvious, the legalization of dark pools for big players would leave small brokerages and retail investors in the dark about what was truly happening in the market.

These concerns were overruled in favor of the Commission’s belief that giving big market players exclusive privacy privileges would “limit the expansion of the anticompetitive effects of off-board trading restrictions.”

In other words, giving big players exclusive “privacy privileges” makes for a more competitive market.

And that’s how dark pools became legal again.

The ‘theoretical’ justification for dark pools

Today, when the obvious advantages dark pools give to big Wall Street players is brought into question, the excuse mill they use to justify them falls into the buckets of:

-

There may be times where large transactions need to be executed privately to avoid rocking the stock price. Their favorite example to give is say, a former CEO with a large holding decides to retire and sell their stake.

-

They need privacy to execute “proprietary trading strategies” (and fraud, too.)

Of course, this directly contradicts their defenses of short selling‘s existence. It’s hard to argue that dark pools don’t drain liquidity from the market. Cushioning an insider sell off also interrupts “efficient price discovery.” Perhaps they mean it in the same playful way the word “Rule” is used in “Rule 19c-3.”

Dark pools hide the big picture about a stock’s true price

Dark pools obscure the real price of shares. Any given stock could have massive orders queued up in the order book, away from public view.

The prices retail investors see on the ticker tapes running across the screens of CNBC and Yahoo Finance generally aren’t truly reflective of active supply-and-demand pressures.

Imagine going to a dealer to buy a truck. When you pull up, you see two trucks in the parking lot. The salesman says these are the only trucks they have in their inventory.

The last dealer you visited only had one truck at about the same price. It seems a little expensive, but you go ahead and buy the truck.

After the paperwork is signed, you are led to the other side of the building. There, through a crack in massive blackout curtains that cover floor-to-ceiling windows, you see another lot packed with trucks. Moreover, the prices painted on the windows are thousands less than what you just paid.

The inventory on the back lot is only available to people in tax brackets much higher than yours.

Dark pool trading is a bit like that, except you’ll never see the back lot.

The very next day, all the trucks in the back lot are sold for $10,000 less than what you paid. The resale value of your truck falls.

Retail investors take note: The price you see on the ticker could very much be – and probably is – an illusion thanks to the SEC’s “regulatory measure,” Rule 19c-3.

Much like short selling, dark pools are one of the many ways Wall Street players can manipulate the market and by extension, a large part of the American economy.

GameStop price action reflects dark pool price manipulation

Frustrated retail investors noted that despite months of numerous brokers reporting significantly more buy orders than sell orders, the prices of meme stocks like GameStop would fall.

For much of 2021, Fidelity, the largest stock broker in the world, showed significantly more buy orders than sell orders, a trend that was mirrored by other brokers. Yet GME shares would still fall in price on these days.

On 8/18/21, Fidelity’s buy-sell ratio on GME was 82% buy, 18% sell. The stock still fell by over 6%. Retail investors suspected buy orders were being handled in dark pools to distort ticker price. Especially considering n this trend repeated itself day after day for months on end. Despite significantly higher demand than supply, the net effect on the price was a downtick.

Note: Orders reflect varying amounts of shares. This can happen if the sell orders were significantly larger than buy orders. Additionally, the ratio displayed above only reflects Fidelity’s buy-sell order ratio for the day.

Something is lurking deep in dark pools in 2021

#darkpools and #darkpoolabuse has been trending on Twitter for months.

In the eleven quarters leading up to and through Q2 of 2020, the percentage of total shares traded in dark pools averaged around 17%.

But Q3 of 2020 saw that figure shoot up to almost 50%. Of course, markets are dynamic, so anomalous spikes and drops happen. Yet Q4 2020 saw the 50% level sustained.

Incredibly, instead of floating back down to Earth, it continued to escalate. The first quarter of 2021 saw a jaw dropping 74% of all shares traded handled exchanged in dark pools. In Q2, it headed back in the right direction, but still landed just shy of 70%.

More than seventy percent of all shares that changed hands in the stock market at large in 2021 did so in dark pools. If this is the SEC’s idea of a ‘limited proposal’ that combats ‘anticompetitive effects,’ retail investors pinning their hopes to regulatory intervention shouldn’t hold their breath.

Massive volume increase

Interestingly, percentage of shares traded in dark pools isn’t the only thing ramping up.

The number of shares traded in the market overall exploded.

The ten quarters between Q1 2018 and Q2 2020 collectively averaged approximately 71 billion shares traded per quarter.

The second quarter of 2021 saw over 500 billion shares change hands. That’s a 700% increase compared to the historical average, and of those trades, almost 70% was executed in dark pools.

What is fueling the frenzied activity that Wall Street tries to frame retail for, (but can’t in this case considering 70% of the activity is happening in Wall Street insider exchanges) is the multi-trillion dollar question.

If this doesn’t reflect market manipulation by Wall Street insiders and marker makers, then all securities regulations are about as “strict” as Rule 19c-3. And much like Rule 19c-3 states, the rule is that when it comes to Wall Street, there are no rules.

Clues in trade size

Total volume percent traded in dark pools aren’t the only metrics going bananas. Trade size has been showing some unusual fluctuations that are rapidly breaking from historical trends.

A trade can contain one share, a thousand shares, or a million shares. In sync with the other exponential ramps from Q3 2020 onward, the trade size on public markets versus dark pool markets have also escalated.

Firstly, the trade sizes on public exchanges have been trending downward.

Between Q1 of 2018 and Q2 of 2020, the average size of trades executed on lit exchanges bounced around between the high 180s and low 200s. The cumulative average across that period came in at 196.4.

However, starting in Q3 of 2020 onward, there was a sharp decline. For the most recent data reported to FINRA, which spanned the period between 04/02/2021–06/30/2021, the average shares per trade on lit exchanges fell to 152.

Over the last four quarters (through 06/30/2021), the cumulative average shares per trade fell to 159.25 – a 19% decline. Strange considering the number of shares changing hands in the market at large was up 700%.

But a 19% fluctuation is small potatoes compared to what’s going on in dark pools over the same period.

Meanwhile, back in the dark pools, the trend is shifting sharply in the opposite direction.

The average dark pool trade size for the ten quarters leading up to Q3 of 2020 clocked in around 7,350.

But in Q3 2020, yet another exponential ramp started. The last four quarters’ average weighed in at just shy of 26,000 per trade – a staggering 350% increase. It peaked in Q1 of 2021 — the prime quarter of meme stock chaos — at almost 36,000 shares per trade.

Swim with caution

This year has been a good one for the stock market.

As of the time of this writing, the NASDAQ is up almost 18% this year, the S&P 500 has clocked just over 20% gains, and the Dow Jones is up almost 14%.

And yet, with a hard majority of the market’s activity hidden from view, something just doesn’t seem right. There must be some impetus for this extreme ramp in the need for discretion and frenzy in behind-the-curtain trading. The question is: What?

The truth is, no one can know for sure. Wall Street has built in cover with “regulatory measures” and “limited proposals” that hide more than 70% of the ‘public market’s’ trading activity from view to everyone but them.

The best we can do is take the information we do have, knowing that this is what the big players have “let” us know.

From there, perhaps a strategic place to start is understanding the depth of what we don’t know.

Jack Tazman

Jack Tazman is a Baltimore, Maryland native. He attended Washington University where he studied political science. Since then, he worked as a writer for various national news organizations specializing in politics and policy. He now resides in New York City as a freelance writer and political consultant.